Navigating Mortgage Rates: How Mattco Realtors Can Help

For most people, buying a home is a significant financial milestone. One of the most critical aspects of purchasing a home is securing a mortgage with favorable terms, and a crucial factor in this equation is the mortgage interest rate. Mortgage rates have a history of fluctuation, impacting the cost of homeownership. In this article, we’ll explore the history of mortgage rates and how a realtor can help you navigate this ever-changing landscape.

Understanding Mortgage Rate History

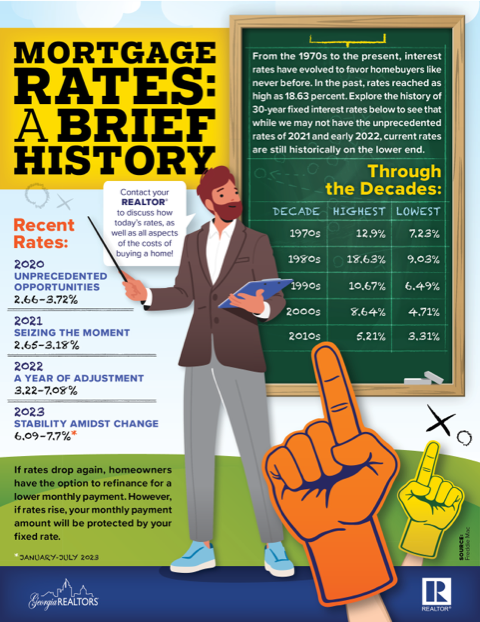

Mortgage rates refer to the interest rate charged by lenders to borrowers for financing their home purchase. These rates have a rich history that reflects the broader economic conditions of the time. Here’s a brief overview of mortgage rate history:

1. Historical Highs: In the early 1980s, mortgage rates reached staggering heights, with some exceeding 18%. This period of exceptionally high interest rates made homeownership challenging and limited the number of people who could afford to buy homes.

2. Post-2008 Financial Crisis: Following the 2008 financial crisis, mortgage rates hit historic lows as central banks implemented policies to stimulate economic recovery. Rates dipped below 4%, making homeownership more accessible for many.

3. Recent Trends: In the years leading up to 2021, mortgage rates remained relatively low, but they exhibited some volatility in response to economic events such as the COVID-19 pandemic.

How Mattco Realtors Can Help

Navigating the ever-changing landscape of mortgage rates can be daunting, but a realtor can be your trusted guide in several ways:

1. Market Expertise: Realtors are well-versed in local real estate markets. They can provide valuable insights into regional trends, helping you understand how mortgage rates in your area might differ from the national average.

2. Lender Connections: Realtors often have established relationships with local lenders. They can connect you with reputable mortgage professionals who can offer you competitive rates and terms based on your financial situation.

3. Timing and Strategy: A seasoned realtor can advise you on the best times to enter the housing market to secure advantageous mortgage rates. They can also help you craft a negotiation strategy that leverages favorable rates to your advantage.

4. Personalized Guidance: Realtors work closely with clients to understand their unique needs and financial situations. This allows them to tailor their advice and recommendations to your specific circumstances, ensuring you make informed decisions.

5. Cost Savings: By helping you secure a lower mortgage rate, a realtor can potentially save you thousands of dollars over the life of your loan. Their expertise can lead to more cost-effective homeownership.

Mortgage rates have a storied history of ups and downs, and understanding this history is crucial when embarking on the journey of homeownership. With the guidance of a skilled realtor like Mattco Realtors, you can make informed decisions about when and how to secure a mortgage, ensuring that you get the best possible terms. By leveraging their market knowledge, lender connections, and personalized guidance, a realtor becomes an invaluable partner in your pursuit of homeownership, ultimately helping you achieve your real estate goals while minimizing your financial burden.

Contact Mattco Realtors for the best full service real estate services in Moultrie and Colquitt County, Georgia.